H1 2025 Foreign Direct Investment (FDI) Accelerates

A Stronger-Than-Expected H1 FDI Investment Results

When we published our inaugural ‘Special Report – Unpacking Dubai’s Real Estate Trajectory’ in June 2025 (refer to the Shine Life Real Estate Instagram Home Page), we articulated a thesis of a re-accelerating “demand-led” Dubai economy amplified by very strong FDI investment, new business start-ups further driving professional migration and inspiring new family formations, resulting in a powerful “Positive Economic Feedback Loop.” We forecasted that Foreign Direct Investment (FDI) would be a significant catalyst for high-quality job creation and, in turn, sustained demand for family housing. Today, we are pleased to share that the latest data from the Dubai government not only validates our view but also significantly surpasses our optimistic predictions.

New Data Analysis: A Breathtaking First Half of 2025

The recently released FDI data for the first half of 2025 confirms Dubai’s unparalleled position as a global economic powerhouse. The new statistics are truly remarkable:

- Soaring Capital Inflows: Dubai attracted an estimated AED 40.4 billion ($11 billion USD) in FDI inflows, marking a staggering 62% increase compared to the first half of 2024.

- Record Project Numbers: The total number of announced FDI projects surged by 28.7% year-over-year to 1,090. Dubai secured the global #1 ranking for Greenfield projects for the eighth consecutive period and achieved a historic high of 643 projects—478 more than the second-ranked city.

- Job Creation Exceeds Expectations: FDI-driven job creation saw a remarkable 46.7% increase to 38,433 jobs in H1 2025, compared to 26,202 jobs a year earlier. This places Dubai at #3 globally for jobs created by Greenfield FDI.

- Global Leadership in Key Sectors: The emirate holds the global #1 ranking for headquarters FDI projects and leads in key clusters, including ICT, creative industries, professional services, life sciences, and financial services.

- Source: Dubai Department of Economy and Tourism (DET), September 2025

The Granular View: Diversity and Quality of FDI Investment

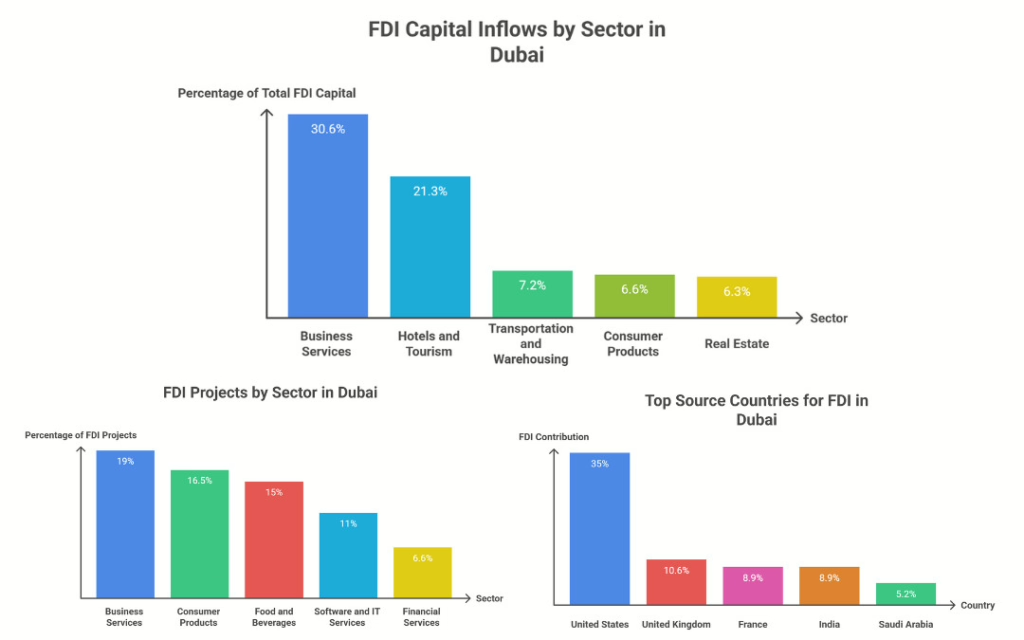

To better understand the strength of this investment trend, it is crucial to look at the diversity of sectors and source countries. This reinforces Dubai’s ability to anticipate global shifts and solidify its position as a global hub for business and talent.

- Leading Sectors by FDI Capital: Business services led with 30.6% of capital inflows, followed by hotels and tourism (21.3%), transportation and warehousing (7.2%), consumer products (6.6%), and real estate (6.3%).

- Leading Sectors by Number of Projects: In terms of project volume, business services again led with 19%, followed by consumer products (16.5%), food and beverages (15%), software and IT services (11%), and financial services (6.6%).

- Top Source Countries: The United States was the top source country, accounting for 35% of FDI inflows, followed by the United Kingdom (10.6%), France (8.9%), India (8.9%), and Saudi Arabia (5.2%).

- Source: Dubai Department of Economy and Tourism (DET), September 2025

High-Quality Job Creation Story: Exceeding Our Predictions

New FDI investment job growth exceeded 46.7% in H1 2025, a considerable surge in growth over the average annual job growth CAGR of 33.7% since 2020 that we highlighted in our previous report. The current H1 2025 data projects that FDI-driven net job creation will likely reach the 80,000 to 85,000 range for the full year 2025.

If this trajectory continues—which we expect it to—our original target of exceeding 100,000 new jobs annually by the full year 2026 will be an easy “layup,” to use a basketball analogy. This further strengthens our core belief that Dubai is more than a simple tourism story; it’s a global economic hub attracting diverse, high-quality investment and talent.

Our View to Clients—A Path to Sustained Capital Appreciation

The economic evolution of Dubai has officially hit a pivotal tipping point. The powerful combination of explosive population growth (driven by educated immigration, corporate expats, and family formations), a dramatic surge in Foreign Direct Investment (FDI), and the visionary leadership of the Dubai government is reigniting an unprecedented economic super-cycle that was only temporarily paused by the COVID event. This dynamic environment presents a truly exceptional and sustained long-term outlook for astute property investors.

When and if we see market moderation, it’s crucial to remember that not all developers or communities feel the impact the same way. Demand for “best in class” properties and communities remains resilient. We advise our clients to focus on:

- Reputable Developers—those with a strong track record of delivery and quality.

- Low-Rise, Low-Density Structures—properties that are attractive to families in spacious and green communities with convenient, high-quality services.

- Family-oriented, large planned community developments with abundant amenities and services.

- Excellent transportation connectivity—especially near metro/mass transit centers.

- Top-Tier Service Sector Amenities—including international schools, hospitals, malls, eateries, and cafes.

- Property Uniqueness & Rarity—factors that ensure above-average capital appreciation in the long run (easy exit).

Invest smart, invest long-term, and be part of Dubai’s remarkable future.

Warm Regards,

Director

T: 52-553-5778

O: 04-228-2868