Recent headlines have suggested a “moderate correction” for Dubai’s residential property market in late 2025 and 2026, primarily due to an anticipated surge in supply. While such forecasts might prompt caution or even paralysis for some, we believe a more nuanced understanding of Dubai’s unique economic engine is essential.

While market adjustments are a natural part of any dynamic economy and may ultimately play out as some suggest, focusing solely on supply-side figures without fully appreciating Dubai’s extraordinary growth catalysts and proactive governmental foresight paints an incomplete picture.

Is the narrative of an impending “correction” truly capturing the full spectrum of opportunity, or are we, in fact, witnessing the early stages of an unprecedented economic super-cycle that will redefine market expectations?

Let’s delve into the layers beneath the surface.

Dubai’s Population Growth Story: Multiple Dynamic Forces at Play

- Dubai’s future residential housing needs are far from simple linear projections. They are the intricate outcome of a highly dynamic ecosystem, profoundly influenced by a powerful confluence of factors:

- Global Events: Geopolitical shifts, global taxation policy shifts and wealth migration, and international business trends constantly reshape demand.

- Tourism: Dubai’s economy and real estate market are highly correlated with tourism. Strong tourism data from diverse geographic regions historically drives robust real estate investments.

- Economic Development & Foreign Direct Investment (FDI): Targeted investment in strategic sectors consistently drives job creation and attracts global talent.

- Intelligent Government Policy: Dubai’s leadership employs agile and far-sighted policies that act as powerful accelerants, often steering the economy through potential headwinds and positioning it for sustained growth.

Positive Feedback Loop: Describes a powerful, self-reinforcing cycle where strategic investments and pro-growth policies create an increasingly attractive environment, leading to sustained economic prosperity and a surge in global investor interest, which in turn draws even more new capital and talent, further accelerating the city’s growth trajectory.

Engineering Growth: Government Initiatives Post-2015 Correction

- Following its last market correction, the Dubai government proactively engineered recovery with a series of transformative initiatives designed to diversify the economy, attract talent, and foster long-term residency. These, alongside continuous economic development plans like the Dubai Industrial Strategy 2030, fundamentally reshaped Dubai’s demographic and economic landscape, incentivizing stable, long-term residency and investment.

- 5-Year Retirement Visa (2018): Attracted retirees from around the world.

- Golden Visa Program (2019 onwards): Offering long-term residency (5-10 years) to investors, entrepreneurs, professionals, and talented individuals.

- 100% Foreign Ownership of Businesses (2021): This reform in the Commercial Companies Law allowed full foreign ownership of onshore companies, significantly boosting entrepreneurial activity and FDI.

- Remote Work Visa (2020): A groundbreaking initiative that allowed professionals to live and work remotely from Dubai, attracting a new wave of skilled individuals amidst global shifts in work patterns.

- Green Visa (2022): Expanded self-sponsorship categories for freelancers, skilled workers, and investors, making it easier for a broader range of talent to reside in Dubai without needing a company sponsor.

Economic Development Plans: Continuous rollout of strategic plans like the Dubai Industrial Strategy 2030 and Dubai Future Districts diversified the economy beyond oil, focusing on advanced manufacturing, logistics, the digital economy, and creative industries.

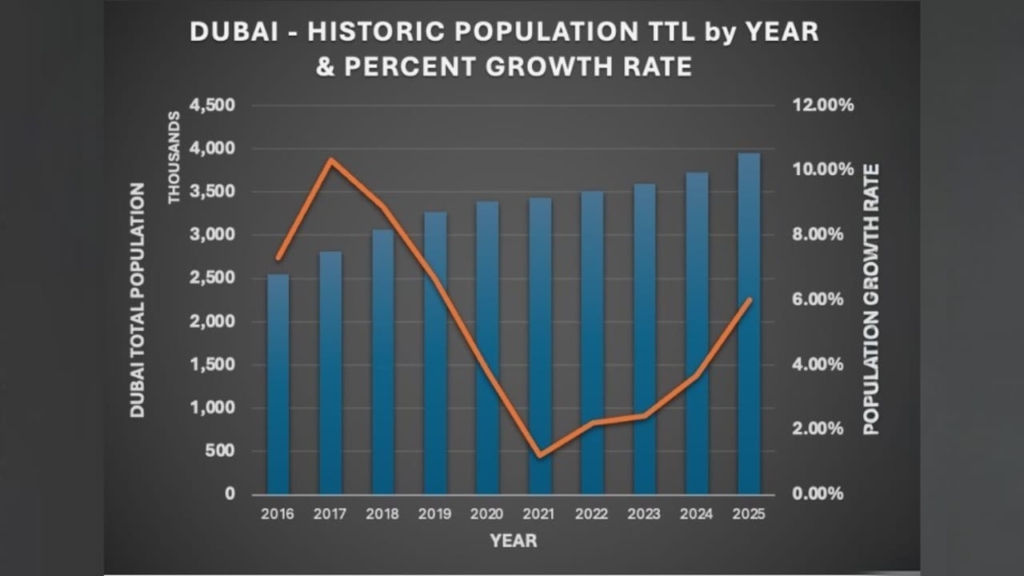

Resilience & Reacceleration: Dubai’s Population Trajectory

- The initial impact of these policies was profound: From 2017 to 2019 (a 3-year period), Dubai experienced an astounding average population CAGR of 8.6%.

- This impressive momentum, however, faced an unforeseen global disruption with COVID-19. Yet, even amidst unprecedented global lockdowns and economic uncertainty, Dubai’s annual population growth from 2021 to 2023 averaged a resilient 1.95%. This remarkable feat, considering the global context, speaks volumes about the inherent strength and appeal of the emirate and the efficacy of its government’s rapid response and proactive policies.

The foundation laid pre-COVID proved robust enough to weather the storm, only temporarily pausing, not derailing, its trajectory.

Is Dubai’s Economy Reaccelerating? The Demand-Side Story

- Is there a compelling case for Dubai entering an accelerated growth period driven by demand? We believe we’re already there. Key economic evidence:

- Surging Foreign Direct Investment (FDI) & Quality Job Creation: Dubai continues to solidify its position as a top global FDI destination. In 2024, Dubai attracted over AED 52.7 billion (approximately $14.24 billion USD) in FDI across 1,826 projects, creating an estimated 58,680 new jobs during this period, marking a 33.2% increase over FY 2023. This influx isn’t just about capital; it’s about establishing high-value businesses that demand and attract global talent, driving the migration of skilled professionals and executives.

- Consider this: FDI-driven new job growth has averaged a CAGR of 33.7% since 2020. If this trend continues, we could see FDI-driven job growth exceed 100,000 jobs annually by 2026. This rapid creation of quality employment directly translates into many new residents and their families needing housing.

- Source: Dubai Department of Economy and Tourism

Pillars of Prosperity: Robust SME & MNC Growth – Preferred GCC Regional Hub

Robust SME Growth & New Business Starts: Small and Medium Enterprises are the backbone of a thriving economy. The total number of registered companies in the UAE grew from 405,000 at the end of June 2020 to over 1.021 million as of mid-2024, representing a 152% growth and a subsequent CAGR of 26% per year. Dubai is a major contributor, holding more than a 59% share of company registrations.

Dubai as a Regional Headquarters Hub: More multinational corporations are strategically choosing Dubai for their GCC regional headquarters, leveraging its world-class infrastructure, connectivity, and business-friendly, low-tax environment. In Q1 2025, Dubai International Chamber reported attracting 53 new large companies to Dubai, a 39% increase year-over-year. This included 11 multinational companies (MNCs), marking a 120% increase over Q1 2024.

Economic Diversification & Non-Oil Sector Growth: Dubai’s non-oil sector continues to be a primary growth engine. In Q1 2025, Dubai’s real GDP grew by 3.6%, largely driven by this sector. Key contributing areas include:

-

- Tourism: Dubai welcomed over 8.68 million international overnight visitors in the January-June 2025 (5-month) period, representing a +7% increase over the same period in 2024 This fuels demand for hospitality, retail, and related services, creating numerous job opportunities. Hotel occupancy also hit a record 82.9% from 81% last year.

- Logistics & Trade with bold infrastructure investment, and the Digital Economy with significant government investment in AI, blockchain, and smart city initiatives.

- Source: Dubai Department of Economy and Tourism

‘Under the Radar’ Statistics Illustrate the Demand- Led Growth Story

- Strong International School & Early Childhood Education Enrollment: Securing placements in highly rated international schools can be challenging, with waiting lists becoming more common. These “under the radar” statistics provide additional insights and support the premise that the Dubai economy is reaccelerating.

- Student enrollment growth in Dubai’s private schools exceeded overall population growth in 2023-2024, with student enrollment CAGR exceeding +10% over the last 3 years (2022 to 2024).

- In addition, early childhood development center enrollment has increased a whopping +17.2% per year over the same 3-year period. These statistics are direct evidence that Dubai is building momentum in the migration and formation of new families, driven by the acceleration of FDI, increased new business starts, and multinational company migration to Dubai. We can’t overstate the importance of achieving the government’s family formation and long-term residency goals towards the future health and stability of the Dubai economy.

- Source: (KHDA)

Challenging the Simplistic View: Dubai’s Future Housing Needs

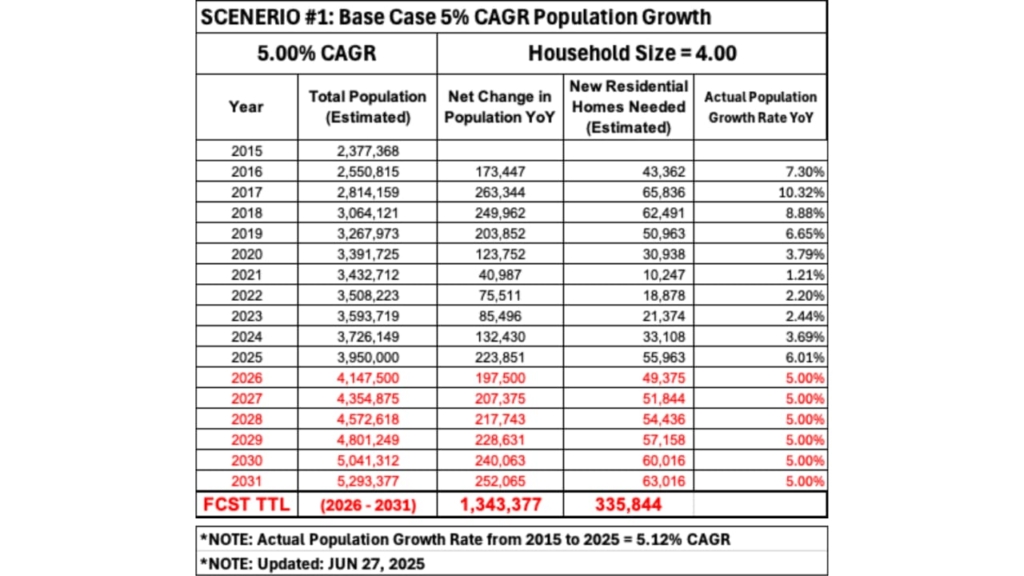

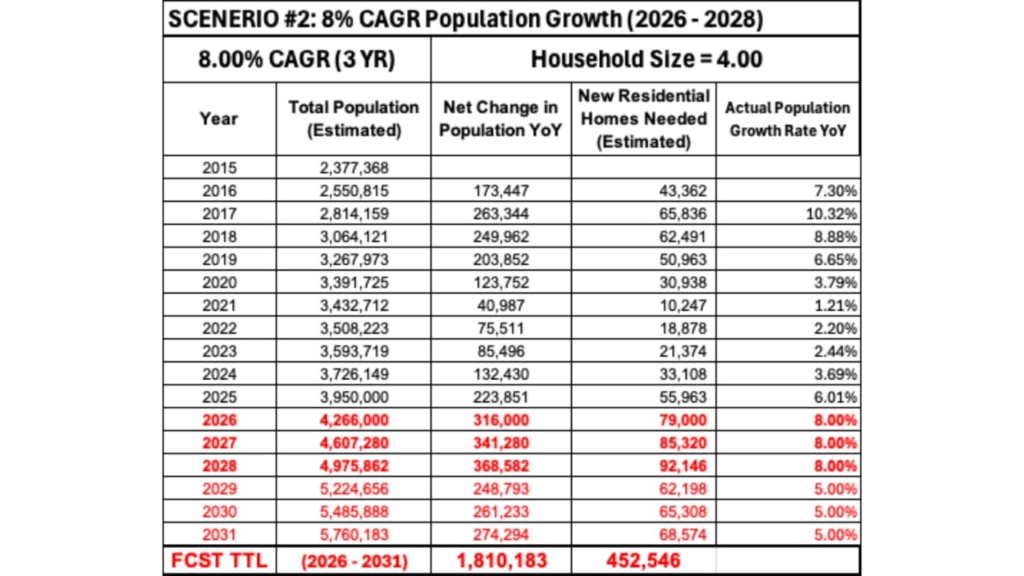

- Many analysts base future housing supply forecasts on a simplistic 5% CAGR population growth, which reflects the 10-year growth trend, albeit including the COVID low-growth period. This is likely an overly simplistic lens for an economy reaccelerating on multiple fronts. Let’s consider the implications for housing needs:

- Scenario 1 (Table 1) Base Case: 5% CAGR Population Growth, 2026-2031: Dubai’s population would increase by ~1,343,377 inhabitants, requiring approximately 335,844 new residential housing units.

- Scenario 2 (Table 2) Reacceleration Case: 8% CAGR Population Growth, 2026-2028: This would mirror the impressive 2016-2018 growth period, Dubai would need an additional 116,702 new residential units over the same 2026-2031 time-period leading to a total requirement of 452,546 units.

This highlights the extremely difficult balancing act the Dubai government is smartly navigating. They proactively plan for higher economic growth, intelligently ‘banking’ ample new off-plan housing development inventory in its pipeline. Furthermore, with advancements in AI, the government is increasingly skilled at reading real-time data on housing supply and demand by district, enabling remarkably precise inventory deployment decisions.

Dubai Government’s Strategic Levers for Market Management

Dubai’s government possesses an arsenal of strategic levers to actively manage the supply of new residential housing units, ensuring stability and investor confidence. These underscore their proactive, business-like approach to market planning:

-

- Land Release and Allocation: Strategic control over undeveloped land.

- Master Plan Directives: The Dubai 2040 Urban Master Plan provides overarching guidelines.

- Developer Licensing and Approvals (RERA/DLD): Stringent regulations like mandated Escrow Accounts (linking buyer funds to construction progress), Financial Guarantees, and close Project Progress Monitoring prevent speculative launches.

- Infrastructure Development Pace: Government investment in roads, transport, and utilities manages supply flow.

- Policy Adjustments: Agile changes to property regulations, visa programs, and business incentives directly influence demand. Based on these robust levers, comprehensive data, and utilization of AI modeling, it’s evident the Dubai government is acting as a strategic, thoughtful business, actively planning and providing flexibility to support its dynamic growth story.

The Power of Dubai’s Positive Feedback Loop

Dubai’s economic growth is increasingly powered by a potent “Positive Feedback Loop.” In economic terms, this occurs when an initial investment generates higher returns, which then attracts even more investment, creating a self-reinforcing upward spiral. This phenomenon is not limited to real estate but is amplifying across the entire Dubai economy:

- Talent Attraction & Innovation: World-class infrastructure, high quality of life, and lucrative opportunities attract top global talent. This influx of human capital, in turn, fuels innovation, entrepreneurship, and productivity, making Dubai even more attractive for businesses and individuals, thus attracting more talent.

- Infrastructure-Led Growth: Strategic investments in smart city technologies, logistics hubs (ports, airports), and connectivity enhance Dubai’s efficiency and global competitiveness. This superior infrastructure then draws more businesses and trade, necessitating further infrastructure development, creating a continuous cycle of growth.

- Policy Success & Global Trust: The government’s consistent delivery on ambitious visions and its proactive, investor-friendly policies builds immense global trust. This trust translates into increased FDI, tourism, and talent migration, which further validates and reinforces the policy-making approach, creating a virtuous cycle of confidence and investment.

As these positive feedback loops gain powerful momentum, how might they contribute to an unexpected and accelerated pace of development and population growth in the coming years?

Our View to Clients – The Path to Sustained Capital Appreciation

What does this mean for our valued real estate clients, particularly family new home buyers? We emphasize a critical perspective: the long-term investment view.

Dubai’s economic evolution has officially hit a pivotal tipping point. The powerful combination of explosive population growth (driven by educated immigration, corporate expats, and family formations), a dramatic surge in Foreign Direct Investment (FDI), and the visionary leadership of the Dubai government is reigniting an unprecedented economic super-cycle that was only temporarily paused by the COVID event. This dynamic environment presents a truly exceptional and sustained long-term outlook for astute property investors.

When and if we see market moderation, it’s crucial to remember that not all developers or communities feel the impact the same way. Demand for ‘Best in Class’ properties and communities remains resilient. Focus on:

-

- Reputable Developers – those with a strong track record of delivery and quality.

- Low-Rise, Low-Density Structures properties that are attractive to families in spacious and green communities with convenient, high quality services.

- Family-Oriented, Large Planned Community Developments with abundant amenities and services.

- Excellent Transportation Connectivity especially near metro/mass transit centers.

- Top-Tier Service Sector Amenities including international schools, hospitals, malls, eateries and cafes.

- Property Uniqueness & Rarity – factors that ensure above-average capital appreciation in the long run (easy exit).

Invest smart, invest long-term, and be part of Dubai’s remarkable future.

Warm Regards,

Tom McLaughlin

Director

Shine Life Real Estate

T: 50-199-8780

O: 04-228-2868